tax avoidance vs tax evasion nz

It is a legal strategy that. People who cheat the tax system are tax criminals.

Pdf The Influence Of Education On Tax Avoidance And Tax Evasion Noor Afza Amran Academia Edu

Any attempt to evade or defeat a tax is punishable by up to 250000 in fines 500000 for corporations five years in prison or a combination of the.

. Tax Evasion is when a citizen tries to evade federal state and income taxes using illegal techniques. Tax evasion is illegal and can potentially get you criminally charged and sentenced to prison fined or both. The main difference between tax evasion and tax avoidance is that evasion is an illegal activity meant to deliberately dodge tax expenses and avoidance is the highly.

In Tax Planning a taxpayer is doing what the govt wants him to do whereas in tax avoidance a taxpayer is doing something which the govt didnt expect the taxpayer to do. What tax crime is Everyone pays tax on their income to help fund public services. One method to avoid taxes is not paying at all or paying less than the obligatory.

Usually tax evasion involves hiding or misrepresenting income. In tax planning a taxpayer is doing what the govt wants him to do whereas in tax. 10 Blacks Law Dictionary 9th ed 2009 Tax Evasion at 1599.

Tax Evasion vs. Tax avoidance and tax evasion are different methods people use to lower taxes. How we deal with tax crime Were committed to dealing.

In tax avoidance you structure your affairs to. Tax evasion is a felony. Tax mitigation is not a term of art14 and recently the New Zealand Supreme Court has said the mitigationavoidance.

Part i tax evasion and general doctrines of criminal law 1996 2 nz j tax l policy 1 at 4. Tax evasion and tax avoidance are used interchangeably to describe such acts. The difference between tax avoidance and tax evasion boils down to the element of concealing.

Unlike tax evasion which relies on illegal methods tax avoidance is a legal method of reducing taxable income or tax owed by an individual or business. This might be underreporting income inflating deductions without proof hiding or not reporting cash transactions or hiding money in offshore accounts. Key Differences between Tax Evasion vs Tax Avoidance.

The distinction between tax evasion and tax avoidance to a great extent comes down to two components. Tax evasion on the other hand is using illegal means to avoid paying taxes. New Zealand has had a general anti-avoidance provision since The Property.

8 John Prebble and Zoe Prebble The Morality of Tax Avoidance 2010 20 Creighton L Rev 101 at 112. Tax avoidance vs tax evasion nz Thursday March 31 2022 Edit. To start with tax avoidance.

The Govt is trying. Its because theres a difference between tax avoidance and tax evasion. Tax evasion is an intentional effort to avoid paying taxes you owe but tax avoidance is a deliberate effort to use resources and tools that lower tax bills.

Tax avoidance is organizing your undertakings with the goal. Tax avoidance sometimes takes. Tax evasion is totally different from tax avoidance.

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

The Property Parent Trap Tax Alert November 2021 Deloitte New Zealand

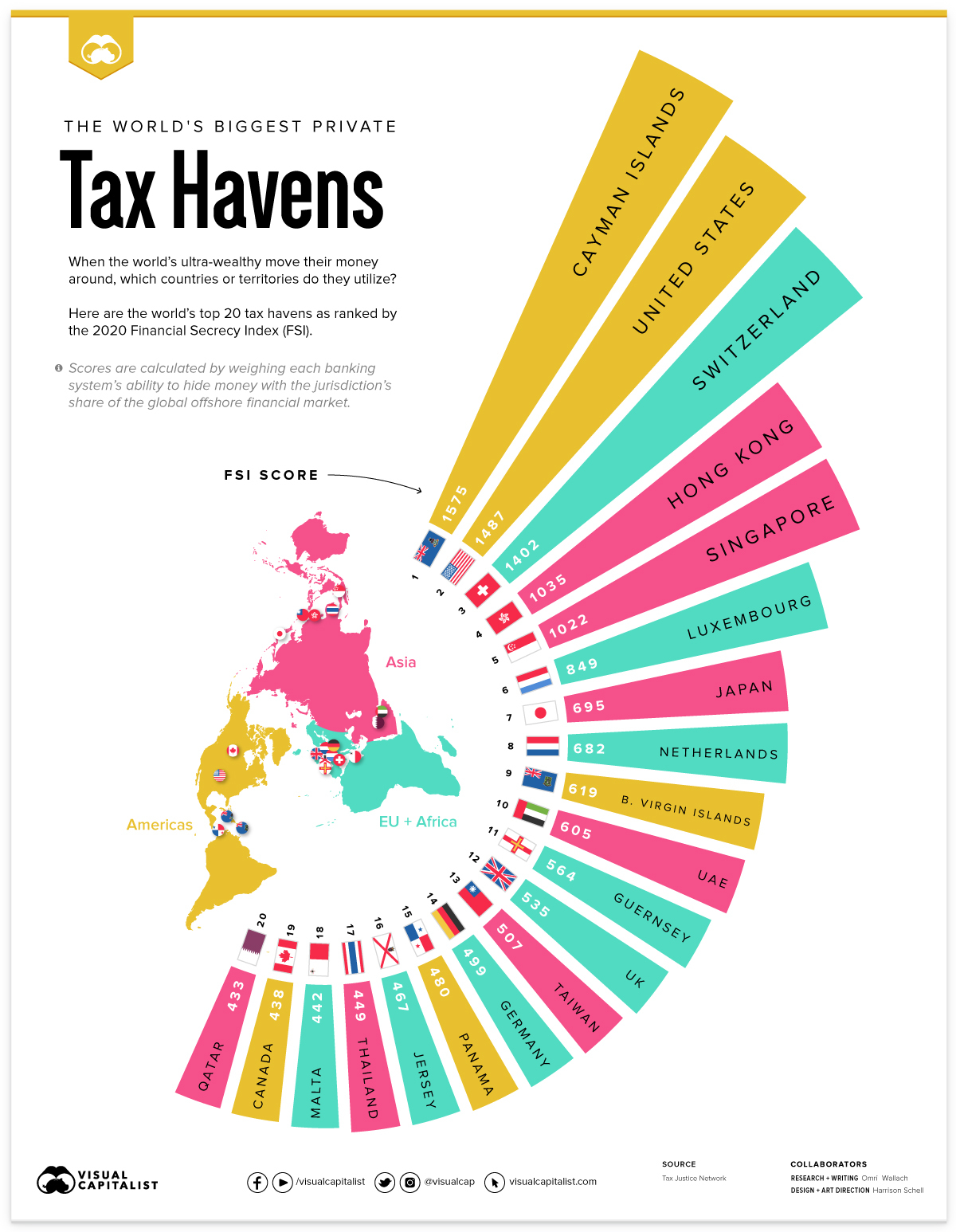

Tax Haven Networks And The Role Of The Big 4 Accountancy Firms Sciencedirect

Pdf Tax Treaties And Tax Avoidance Application Of Anti Avoidance Provisions

The Pandora Papers Show The Line Between Tax Avoidance And Tax Evasion Has Become So Blurred We Need To Act Against Both

Mapped The World S Biggest Private Tax Havens In 2021

It S A Matter Of Fairness Squeezing More Tax From Multinationals Financial Times

Tax Evasion Vs Tax Avoidance Know The Difference Ico Services

Difference Between Tax Avoidance And Tax Evasion With Comparison Chart Key Differences

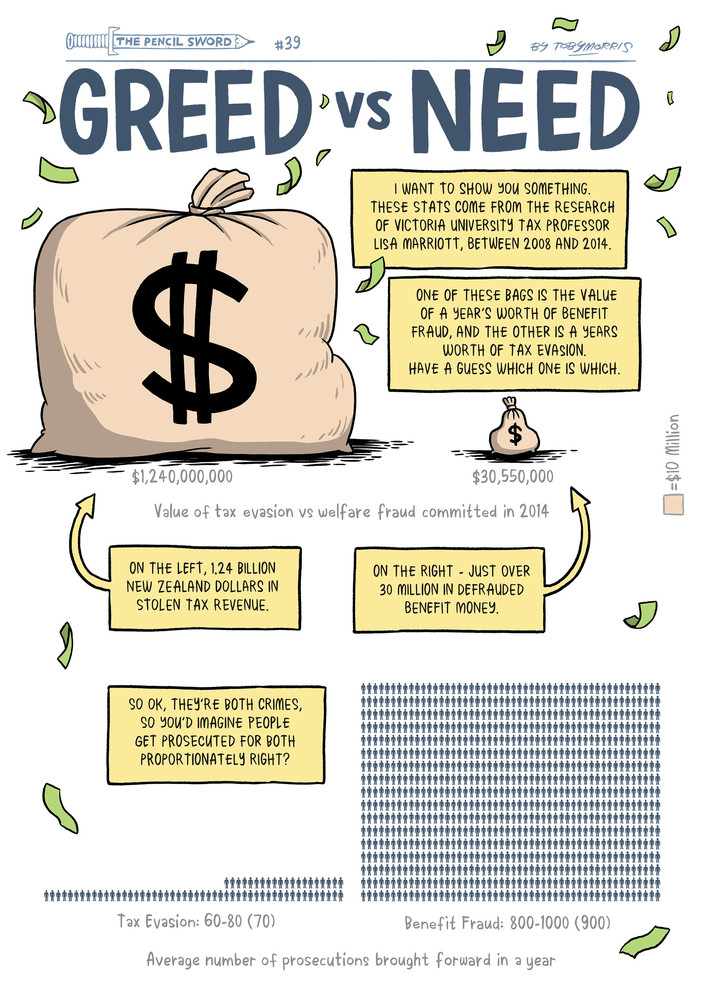

Pencilsword Greed Vs Need The Standard

Differences Between Tax Avoidance Vs Tax Evasion Vs Tax Planning

The Case For A Robust Attack On The Tax Gap U S Department Of The Treasury

Environmental Regulation And Corporate Tax Avoidance Evidence From China Plos One

Difference Between Tax Evasion And Tax Avoidance Compare The Difference Between Similar Terms

Consumption Tax Policies Consumption Taxes Tax Foundation

International Tax Competitiveness Index Tax Foundation

The Case For A Robust Attack On The Tax Gap U S Department Of The Treasury

How Raising Tax For High Income Earners Would Reduce Inequality Improve Social Welfare In New Zealand